What does Volery do?

A data intelligent platform with exclusive tools for venture investors to maximize their returns.

Over the course of pre-investment, during it and post-investment, Volery simplifies the ad-hoc tasks for the investor with intelligent tools, that help manage the deal flow automatically.

A one-stop roof for investors to get a holistic picture of their investment portfolio.

Volery highlights from the first 12 months of operations

0+

No of deals done

$0M

Average Deal Size

0+

Investor network size

$0M to $0M

Target Raise

Our Partners

Portfolio Management

We provide a convenient way to track the

investment portfolio.

Automatically update the startup’s KPIs and help investors

track

their portfolio promptly and measure current investment value

Pipeline Management

We provide a simple dashboard to track all the

deals in the pipeline.

Representation of deals in an organized manner making it

easy for

the investors to monitor the status

Curated Deal Sourcing

With deals accessed from a global network, Volery

uses data

to curate the deal flow and match the investment preference

for

investors

Deal Syndication

We facilitate faster capital syndication for the

startup by

allowing the investor to share the deal with other investors for

co-investment.

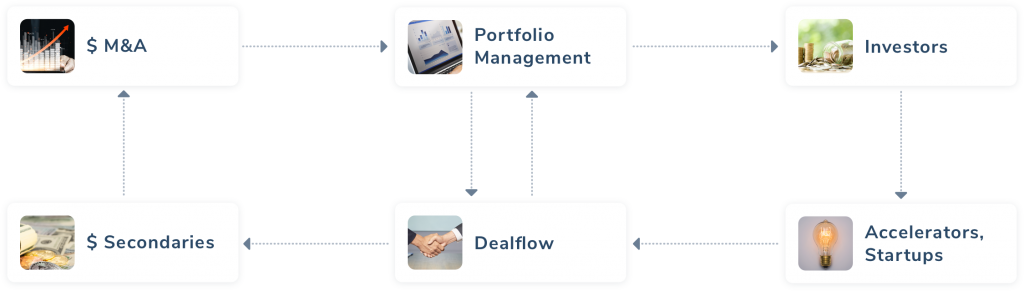

Data As Core

“Creating a virtuous loop of data driven decision making, generating actionable signals from noise” as a statement beneath this loop diagram

“Supported by Artificial Intelligence to parse the avalanche of data to generate signals and actionable insights”

$ M&A

Portfolio Management

Investors

$ Secondaries

Dealflow

Accelerators, Startups

Features

Volery is an exclusive platform providing

Intelligent tools to

maximize Venture Returns for the Investors